What Is Note Payable Long Term? Expert Guidance

Understanding the complexities of financial instruments is crucial for both individuals and businesses. Among these, notes payable long term represent a significant aspect of a company’s financial obligations. In this comprehensive guide, we will delve into the concept of notes payable long term, exploring what they are, how they function, and their implications for financial health.

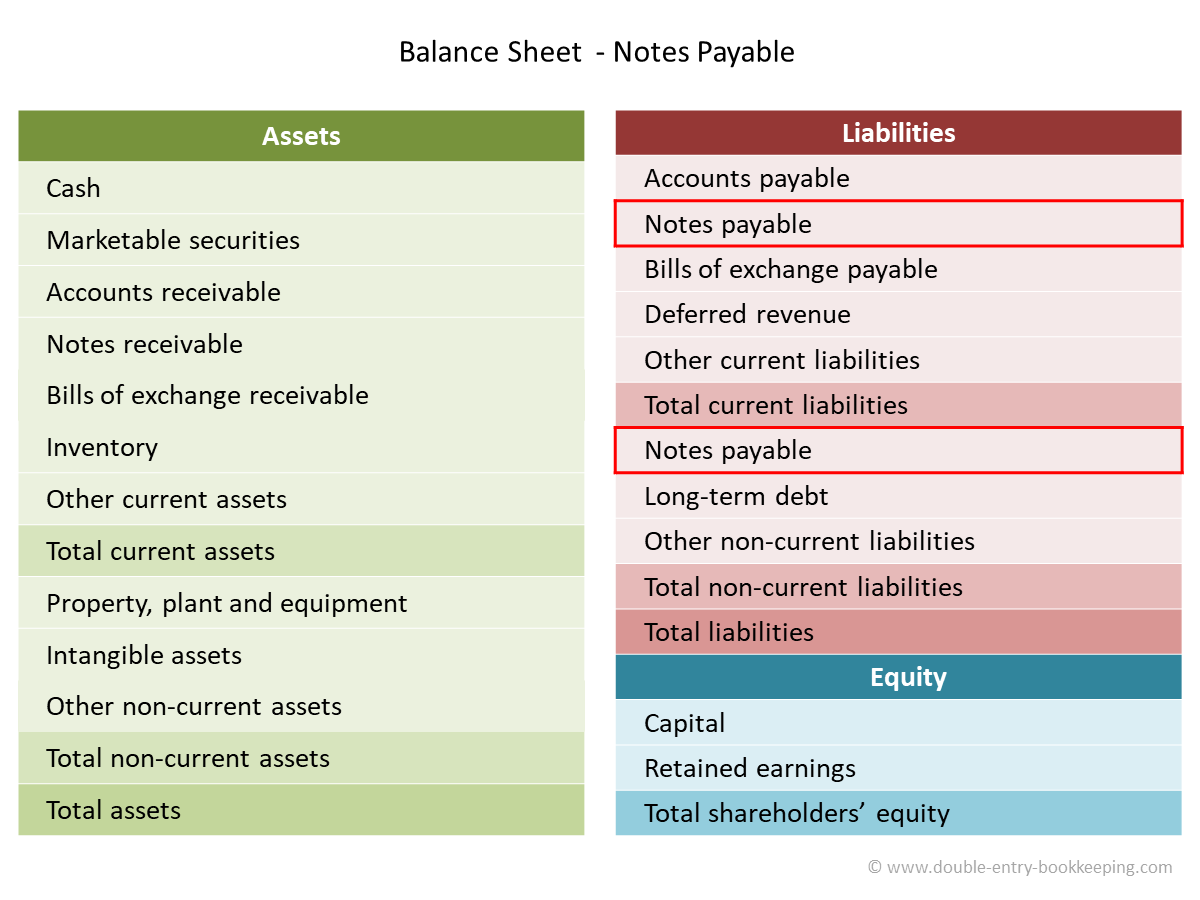

Notes payable long term are essentially debts that a company owes to its creditors, with the obligation to repay these debts over an extended period, typically more than one year. This financial instrument is documented in the form of a promissory note, which outlines the terms of the debt, including the principal amount, interest rate, repayment schedule, and maturity date. The long-term nature of these notes signifies that the repayment is not expected in the near future, which can have various implications for the company’s financial planning and strategy.

Importance of Notes Payable Long Term

The presence of notes payable long term on a company’s balance sheet indicates its dependence on long-term debt financing. This form of financing can be beneficial for several reasons:

Funding Large Projects: Companies often use long-term notes payable to finance large-scale projects that are expected to generate returns over an extended period. The lengthy repayment term aligns with the project’s lifecycle, ensuring that the company can manage its cash flows effectively.

Spreading Out Liability: By having a portion of their debt as long-term notes payable, companies can mitigate the risk of immediate liquidity crises. This strategic distribution of liabilities can help in managing financial obligations more sustainably.

Tax Benefits: Interest paid on long-term debt, including notes payable, is often tax-deductible, which can help in reducing the company’s taxable income and, consequently, its tax liability.

Analysis of Notes Payable Long Term

When analyzing notes payable long term, several factors come into play, reflecting on their impact on the company’s financial health and future prospects:

Debt-to-Equity Ratio: This ratio helps in understanding the balance between the company’s debt financing and equity financing. A high ratio may indicate a higher dependence on debt, potentially increasing the financial risk.

Interest Coverage Ratio: This metric determines the company’s ability to meet its interest payments. A lower ratio could suggest difficulties in servicing the debt, which might have negative implications for the company’s credit rating and future borrowing capacity.

Current Ratio and Liquidity: While notes payable long term are not due immediately, their presence affects the company’s overall debt profile. A higher proportion of long-term debt might not immediately impact liquidity but can influence long-term solvency and the ability to meet future obligations.

Managing Notes Payable Long Term Effectively

Effective management of notes payable long term involves a combination of financial planning, strategic decision-making, and risk management. Companies can adopt several strategies to manage these debts:

Debt Refinancing: Considering the interest rate environment, companies might refinance their long-term debt to take advantage of lower rates, reducing their interest expenses.

Financial Flexibility: Maintaining a healthy cash reserve and ensuring access to additional liquidity sources can provide the flexibility needed to meet unexpected financial challenges.

Diversified Funding: Relying on a mix of short-term and long-term, as well as debt and equity financing, can help in optimizing the capital structure and minimizing financial risk.

Conclusion

In conclusion, notes payable long term represent a critical component of a company’s financial obligations, offering a means to finance long-term projects and manage cash flows effectively. However, their management requires careful consideration of the company’s financial health, strategic objectives, and risk tolerance. By understanding the implications of notes payable long term and adopting effective management strategies, companies can navigate their debt obligations more efficiently, ensuring a sustainable financial future.

Frequently Asked Questions

What are notes payable long term?

+Notes payable long term are debts that a company owes to its creditors, repayable over more than one year, documented in the form of a promissory note that outlines the debt terms.

Why are notes payable long term important?

+They are crucial for financing large projects, spreading out liabilities, and offering tax benefits through interest deductions, thus supporting a company's long-term financial strategy.

How can companies manage notes payable long term effectively?

+Through debt refinancing, maintaining financial flexibility, and ensuring a diversified funding mix, companies can manage their long-term debt efficiently and mitigate associated risks.

What are the key considerations when analyzing notes payable long term?

+Key considerations include the debt-to-equity ratio, interest coverage ratio, and the overall impact on the company's liquidity, solvency, and credit rating.

Can notes payable long term affect a company's credit rating?

+Yes, a high level of long-term debt can impact a company's credit rating, as it may indicate a higher financial risk and affect its ability to meet future debt obligations.

How do interest rates impact notes payable long term?

+Changes in interest rates can significantly impact notes payable long term, particularly if the debt is variable-rate. Lower interest rates can reduce the cost of debt, while higher rates can increase it, affecting the company's profitability and cash flows.

In navigating the complexities of notes payable long term, it’s essential for companies to maintain a forward-looking approach, balancing their financing needs with the management of financial risk. By doing so, they can harness the benefits of long-term debt financing while ensuring a stable and sustainable financial foundation for their future endeavors.