What Is Emergency Fund For Single Moms? Financial Safety

Having a financial safety net is crucial for anyone, but it’s especially important for single moms who often bear the sole responsibility of providing for their families. An emergency fund for single moms serves as a cushion against unexpected expenses, financial setbacks, and other monetary challenges that may arise. It’s a pool of savings set aside to cover essential costs in case of an emergency, ensuring that single moms can continue to provide for their children without succumbing to financial stress.

Understanding the Importance of Emergency Funds

Single moms face unique financial challenges. They may have limited income, higher expenses due to childcare costs, and less access to resources that could help them during financial downturns. An emergency fund can be a lifeline in such situations, providing the financial flexibility to address emergencies without going into debt or compromising their ability to provide for their children’s needs.

Components of an Emergency Fund for Single Moms

Savings Amount: The general rule of thumb is to save enough to cover 3 to 6 months of essential expenses. However, the amount can vary based on individual circumstances, such as job security, dependents, and income stability.

Essential Expenses: These include rent/mortgage, utilities, groceries, transportation, minimum debt payments, and insurance premiums. The goal is to ensure that, even in an emergency, single moms can cover these basic costs.

Accessibility: Emergency funds should be easily accessible in case of an emergency. This means keeping the money in a savings account or a liquid, low-risk investment that can be quickly converted into cash.

Budgeting: Single moms should budget a portion of their income towards building and maintaining their emergency fund. Even small, regular contributions can add up over time.

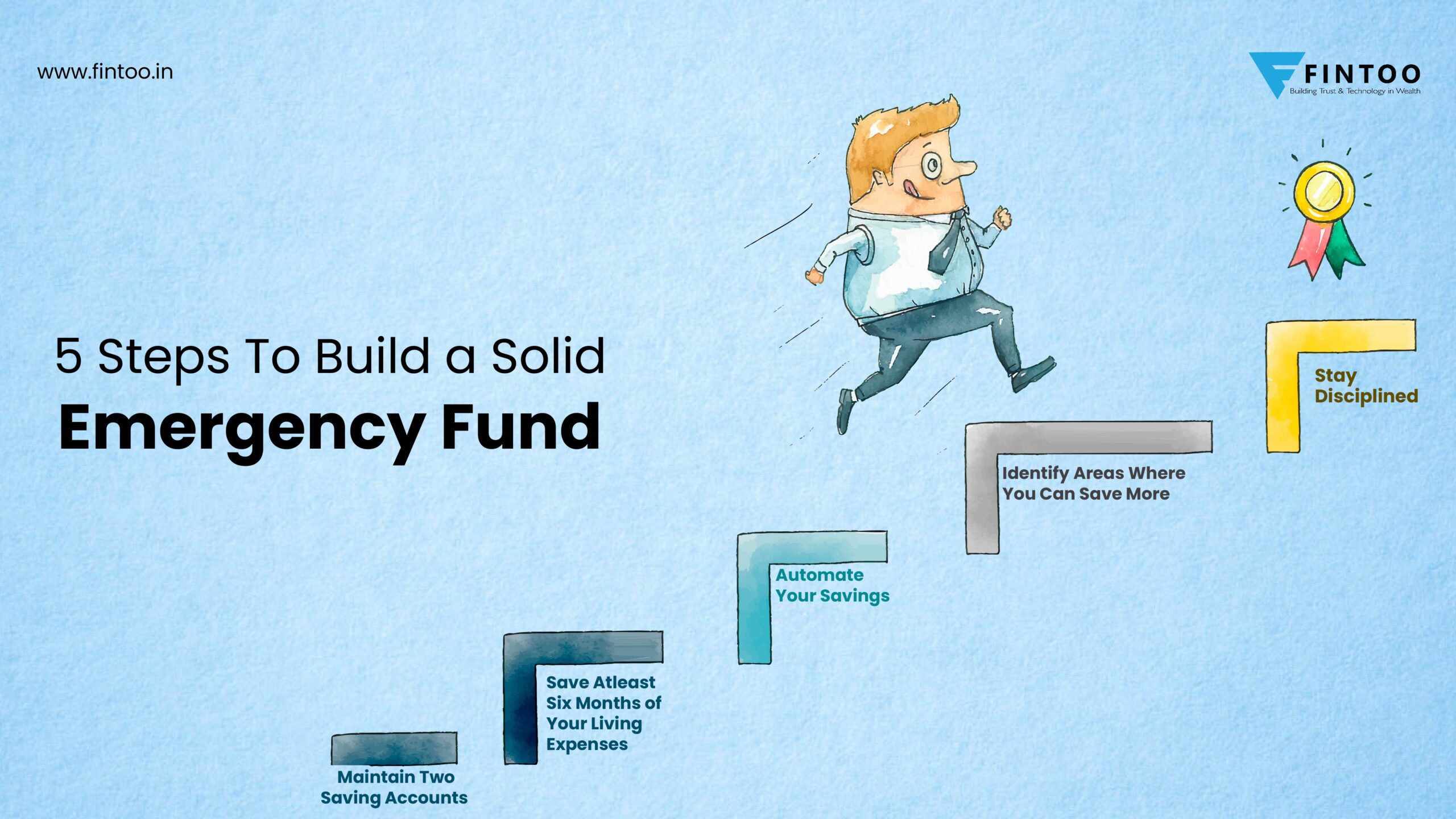

Building an Emergency Fund as a Single Mom

Step 1: Assess Your Finances

Start by understanding where your money is going. Track your expenses for a month to identify areas where you can cut back and allocate that money towards your emergency fund.

Step 2: Set a Realistic Goal

Given your income and expenses, determine how much you can realistically save each month towards your emergency fund. Start with a manageable goal, even if it seems small, and increase it as your financial situation improves.

Step 3: Choose the Right Account

Open a separate savings account specifically for your emergency fund. Consider a high-yield savings account that earns interest, helping your savings grow over time.

Step 4: Automate Your Savings

Set up automatic transfers from your checking account to your emergency fund account. This way, you ensure that you save a fixed amount regularly, without having to think about it.

Step 5: Prioritize Needs Over Wants

Be disciplined about distinguishing between essential expenses and discretionary spending. Prioritize building your emergency fund over non-essential purchases.

Overcoming Challenges

Single moms often face numerous challenges, including time constraints, emotional stress, and limited financial resources. However, by prioritizing their financial well-being and taking small, consistent steps towards building an emergency fund, they can achieve financial stability.

Leveraging Additional Resources

- Government Assistance: Depending on your location and income level, you may be eligible for government assistance programs that can help with expenses such as childcare and healthcare.

- Non-Profit Organizations: Many non-profit organizations offer financial assistance, education, and support specifically for single mothers.

- Financial Counseling: Consider seeking advice from a financial advisor who can provide personalized guidance on managing your finances and building your emergency fund.

Conclusion

An emergency fund is not just a safety net; it’s a foundation for long-term financial health and stability. For single moms, it represents a way to ensure their children’s well-being even in the face of unexpected challenges. By understanding the importance of emergency funds, taking deliberate steps to build them, and leveraging available resources, single moms can secure their financial futures and reduce financial stress.

How much should a single mom save for an emergency fund?

+Aiming to save enough to cover 3 to 6 months of essential expenses is a good rule of thumb. However, this amount can vary based on individual circumstances such as job security and income stability.

What are essential expenses that an emergency fund should cover?

+Essential expenses include rent/mortgage, utilities, groceries, transportation, minimum debt payments, and insurance premiums. The goal is to ensure these basic needs are met even during financial emergencies.

How can single moms prioritize building an emergency fund?

+Single moms can prioritize their emergency fund by assessing their finances, setting realistic savings goals, choosing the right savings account, automating their savings, and distinguishing between essential expenses and discretionary spending.