Washington State Tax Exemption Form

Navigating the complexities of tax exemptions can be a daunting task, especially for businesses and individuals in the state of Washington. The Washington State tax exemption form is a crucial document for those seeking to claim exemptions from sales and use taxes on qualified purchases. To better understand the process and requirements, let’s delve into the specifics of the form, its application, and the broader implications of tax exemptions in Washington State.

Eligibility for Tax Exemptions

Before diving into the form itself, it’s essential to establish eligibility for tax exemptions. In Washington State, certain types of organizations and purchases are exempt from sales and use taxes. These include, but are not limited to, government entities, non-profit organizations with a 501©(3) status, and in some cases, tribal entities. Additionally, specific types of purchases, such as equipment for manufacturing or research and development, may also qualify for exemptions.

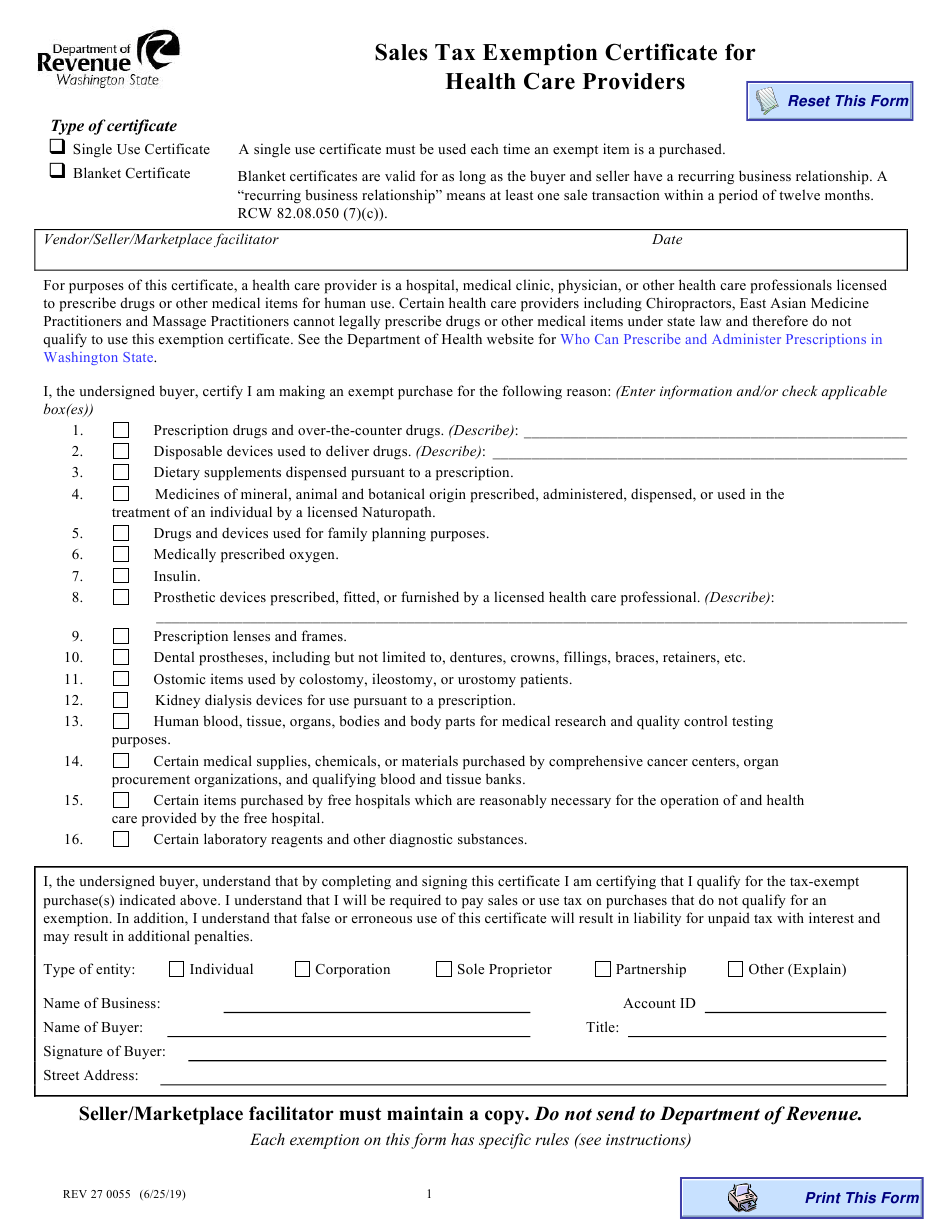

The Tax Exemption Form

The Washington State tax exemption form, typically referred to as the “Seller’s Tax Exemption Certificate” or a similarly titled document, serves as a declaration by the buyer that the purchase qualifies for a tax exemption. This form is crucial because it shifts the responsibility from the seller to the buyer to ensure the purchase is exempt from taxes. The form will usually require information such as:

- Business Information: The buyer’s name, address, and contact information.

- Tax Identification Number: The buyer’s Unified Business Identifier (UBI) number or federal Employer Identification Number (EIN).

- Exemption Reason: A clear statement of why the purchase is exempt from sales tax, including the relevant code or category of exemption.

- Purchase Details: Description of the items being purchased and their intended use.

How to Apply for a Tax Exemption

Applying for a tax exemption in Washington State involves several steps:

- Determine Eligibility: Ensure your organization or the specific purchase qualifies for a tax exemption.

- Obtain Necessary Documents: Depending on the type of exemption, you may need to provide documentation such as a 501©(3) letter from the IRS for non-profit organizations.

- Fill Out the Exemption Form: Complete the seller’s tax exemption certificate accurately and thoroughly.

- Submit the Form: Provide the completed form to the seller at the time of purchase.

- Record Keeping: Maintain accurate records of exempt purchases, as these may be subject to audit.

Implications of Tax Exemptions

Tax exemptions play a significant role in promoting certain economic activities and supporting non-profit and government sectors. By exempting qualified purchases from sales and use taxes, Washington State aims to encourage investments in areas such as manufacturing, technology, and social services. However, the process of claiming these exemptions must be approached with diligence and transparency to ensure compliance with state tax laws and to maintain the integrity of the tax system.

FAQs

What types of organizations are eligible for tax exemptions in Washington State?

+Eligible organizations include government entities, non-profit organizations with a 501(c)(3) status, and certain tribal entities. Specific types of purchases, like those for manufacturing or research, may also qualify.

How long is a tax exemption certificate valid in Washington State?

+The validity period can vary depending on the type of exemption. Some certificates may need to be updated annually, while others may remain valid until the business's tax status changes.

Can a tax exemption be revoked in Washington State?

+Yes, if it's found that a business or individual falsely claimed a tax exemption, the state can revoke the exemption and require payment of the taxes that were not paid, along with potential penalties and interest.

Conclusion

Navigating the world of tax exemptions in Washington State requires a deep understanding of the eligibility criteria, the application process, and the maintenance of accurate records. By leveraging tax exemptions effectively, businesses and organizations can allocate more resources to their core activities, contributing to the economic and social development of the state. However, compliance with tax laws and regulations is paramount to ensuring that these exemptions are used as intended. As tax laws evolve, staying informed about changes and updates to exemption policies will be essential for those seeking to claim these benefits.