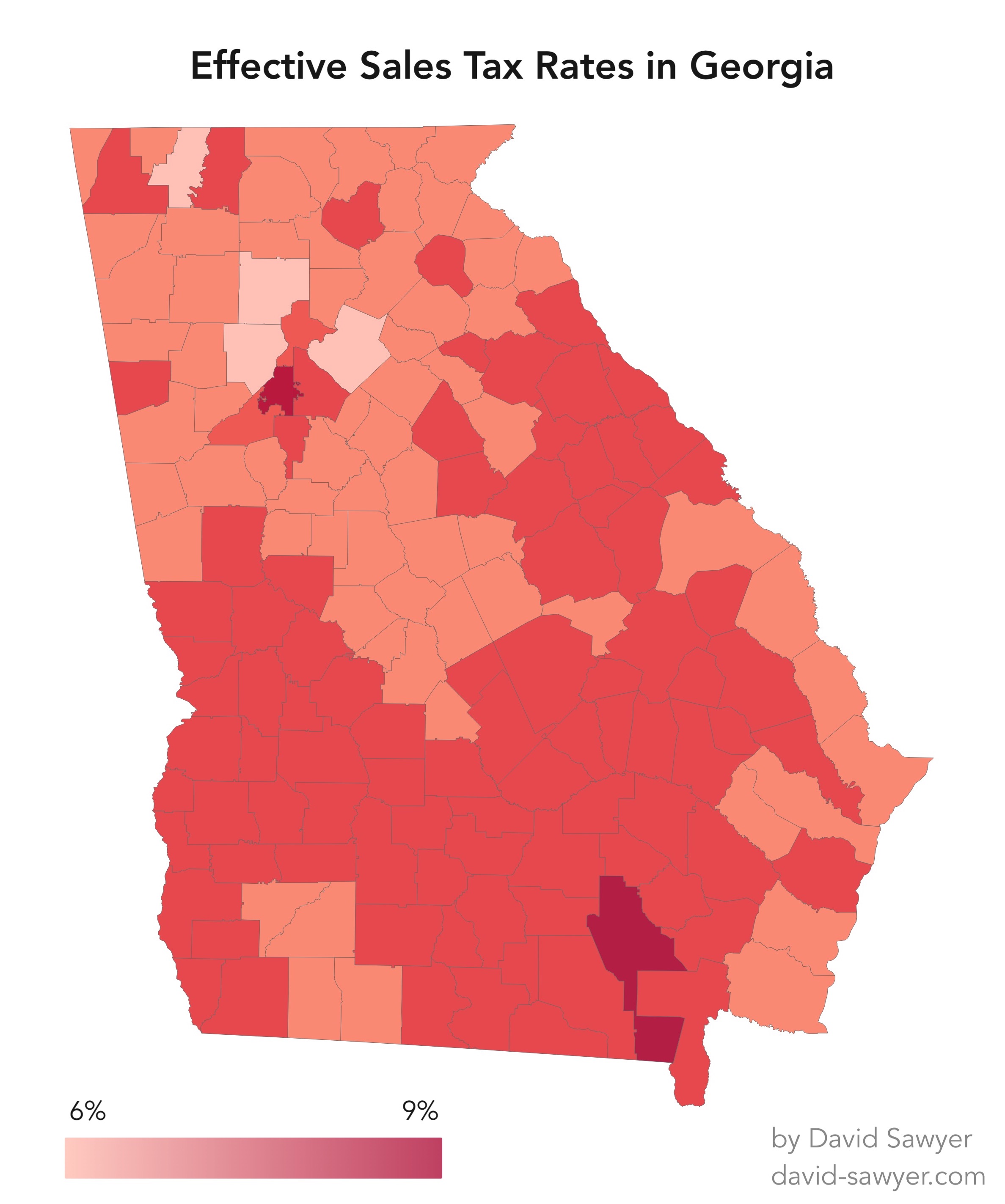

Georgia County Sales Tax Rates

In the state of Georgia, sales tax rates vary by county, with a combination of state and local taxes applied to most purchases. The state imposes a base sales tax rate of 4%, but counties can add their own local sales tax rates, making the overall sales tax rate range from 4% to 8% across different parts of the state. This variation in sales tax rates can significantly impact both businesses and consumers, affecting pricing, revenue, and consumer behavior.

Understanding Sales Tax in Georgia

Before diving into the specifics of each county’s sales tax rate, it’s essential to understand how sales tax works in Georgia. The state’s sales tax is levied on the sale of tangible personal property and certain services. The base state sales tax rate is 4%, but this can be increased by local jurisdictions (counties and cities) to fund local projects and services. The total sales tax rate is the sum of the state rate and any local rates that apply.

Local Sales Tax Options

Georgia allows local governments to impose additional sales taxes for specific purposes, such as:

- Special Purpose Local Option Sales Tax (SPLOST): Used for financing specific capital projects or initiatives.

- Local Option Sales Tax (LOST): Can be used for a broader range of purposes, including operational expenses and capital projects.

- Educational Special Purpose Local Option Sales Tax (ESPLOST): Dedicated to funding school system needs.

These local taxes can vary significantly from one county to another, depending on the specific needs and priorities of each local government.

Georgia County Sales Tax Rates

As of the last update, the sales tax rates in Georgia’s counties reflect a mix of state and local taxes. Here’s a snapshot of sales tax rates across some of the counties:

- Fulton County: 8.9% (includes 4% state tax, 3% county tax, and 1.9% local tax for special projects)

- Gwinnett County: 6% (4% state tax and 2% county tax)

- Cobb County: 6% (4% state tax and 2% county tax)

- DeKalb County: 8% (4% state tax and 4% county tax)

- Cherokee County: 6% (4% state tax and 2% county tax)

- Clayton County: 8% (4% state tax and 4% county tax)

- Forsyth County: 6% (4% state tax and 2% county tax)

- Hall County: 7% (4% state tax and 3% county tax)

- Henry County: 7% (4% state tax and 3% county tax)

Impact on Businesses and Consumers

The variation in sales tax rates across Georgia’s counties can have significant implications for businesses and consumers alike. For businesses, understanding the sales tax rate in their operational area is crucial for pricing goods and services correctly. Consumers, on the other hand, might find themselves considering the sales tax when making purchasing decisions, especially for big-ticket items.

Future Trends and Considerations

As Georgia continues to grow economically and demographically, there may be changes in how sales taxes are structured and applied. The rise of e-commerce and digital services has already prompted discussions about how to fairly apply sales taxes in a way that does not disadvantage local businesses. Future trends may include efforts to simplify sales tax structures, making it easier for businesses to comply and for consumers to understand the taxes they pay.

Conclusion

The sales tax landscape in Georgia is complex, with rates varying significantly from one county to the next. Understanding these rates is essential for both businesses and individuals to make informed decisions about where to locate, shop, and invest. As the state and its local jurisdictions continue to evolve, the application and rates of sales taxes will likely undergo changes, aiming to balance the need for revenue with the impact on local economies and consumer behavior.

How are sales tax rates determined in Georgia counties?

+Sales tax rates in Georgia counties are determined by the state’s base rate of 4% plus any additional local sales taxes approved by the county. These local taxes can include SPLOST, LOST, and ESPLOST, which are used to fund various local projects and services.

Which county in Georgia has the highest sales tax rate?

+As of the last update, some counties like Fulton and DeKalb have higher sales tax rates, reaching up to 8% or more when combining state and local taxes. However, rates can change, so it’s essential to check the current rate for any specific county.

How do sales taxes affect businesses in Georgia?

+Sales taxes can significantly impact businesses in Georgia, particularly in terms of pricing strategies and compliance with tax laws. Businesses must understand the sales tax rates in their area to correctly charge customers and remit taxes to the state and local governments.