Federal Employee Student Loan Repayment

Navigating the complexities of student loan repayment can be a daunting task, especially for federal employees who may be juggling multiple financial responsibilities. The Federal Student Loan Repayment Program (FSLRP) is a valuable benefit that can help alleviate some of this financial burden, but understanding the intricacies of the program is crucial to maximize its advantages.

To begin with, it’s essential to recognize that the FSLRP is a recruitment and retention tool designed to help federal agencies attract and retain top talent in the competitive job market. The program allows agencies to repay federally insured student loans as a benefit to their employees, with the goal of improving employee satisfaction, reducing turnover, and enhancing overall workforce performance.

Eligibility Requirements

Not all federal employees are eligible for the FSLRP. To qualify, employees must meet specific requirements, including:

- Being a full-time permanent employee of a participating federal agency

- Having a minimum of $10,000 in outstanding federally insured student loans

- Agreeing to a service agreement that commits them to working for the agency for a specified period (typically 3 years)

- Meeting specific performance and conduct requirements

It’s worth noting that some agencies may have additional eligibility requirements or restrictions, so it’s crucial for employees to review their agency’s policies and procedures before applying.

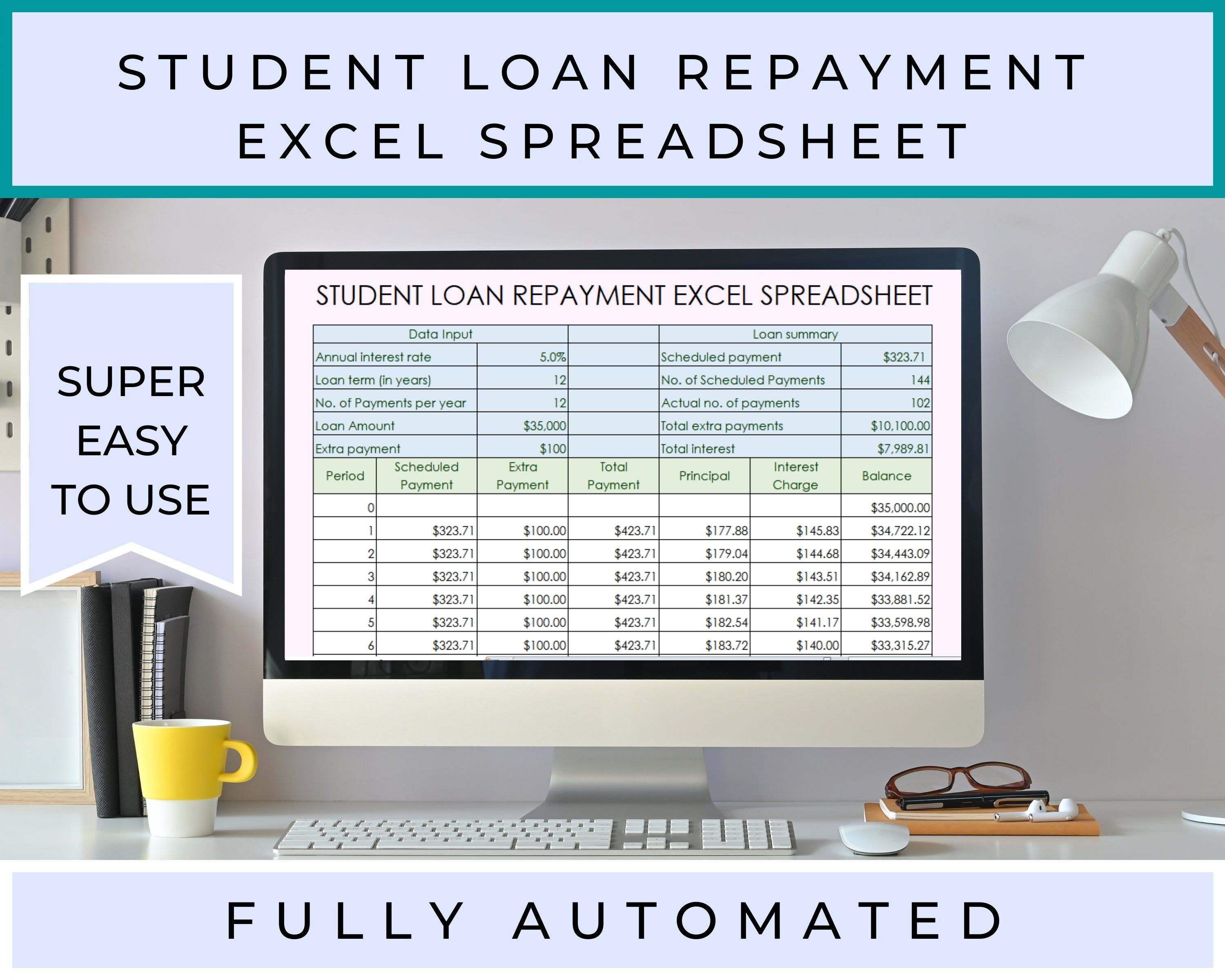

How the Program Works

The FSLRP allows participating agencies to repay up to 10,000 per year, with a maximum of 60,000 per employee, towards outstanding federally insured student loans. The repayment amounts are typically made directly to the loan servicer and can be used to pay down principal and interest on the loans.

To participate in the program, employees must submit an application to their agency, which will review and approve the request. Once approved, the agency will work with the loan servicer to facilitate the repayment process.

Benefits and Advantages

The FSLRP offers numerous benefits and advantages to federal employees, including:

- Reduced financial burden: By repaying a portion of their student loans, employees can reduce their monthly payments and free up more money in their budget for other expenses.

- Improved employee satisfaction: The FSLRP can help improve employee morale and job satisfaction, as it demonstrates the agency’s commitment to supporting their employees’ financial well-being.

- Increased retention: The program can help agencies retain top talent, as employees are more likely to stay with an agency that offers valuable benefits like student loan repayment.

- Enhanced recruitment: The FSLRP can be a powerful recruitment tool, as it sets federal agencies apart from private sector employers and highlights their commitment to supporting employees’ financial goals.

Comparing the FSLRP to Other Repayment Options

The FSLRP is just one of several student loan repayment options available to federal employees. Other options include:

- Public Service Loan Forgiveness (PSLF): This program forgives the remaining balance on a borrower’s Direct Loans after 120 qualifying payments.

- Income-Driven Repayment (IDR) plans: These plans adjust monthly payments based on income and family size, and can help borrowers qualify for forgiveness after 20 or 25 years.

- Loan consolidation: This involves combining multiple loans into a single loan with a lower interest rate and lower monthly payments.

While these options can be valuable, they may not offer the same level of benefits and flexibility as the FSLRP. For example, the FSLRP allows agencies to repay a portion of the loan principal, which can help reduce the overall debt burden, whereas PSLF and IDR plans typically only forgive a portion of the interest.

Case Study: Success Stories

Several federal agencies have reported significant success with the FSLRP, including:

- The Department of Veterans Affairs, which has used the program to attract and retain top talent in the healthcare field.

- The Department of Defense, which has seen a significant reduction in turnover rates among employees participating in the program.

- The Federal Bureau of Investigation, which has used the FSLRP to recruit and retain agents with specialized skills and expertise.

These success stories highlight the potential of the FSLRP to drive positive outcomes for both employees and agencies.

Expert Insights

According to experts, the FSLRP is a valuable benefit that can help federal employees achieve financial stability and security. “The FSLRP is a game-changer for federal employees struggling with student loan debt,” says one expert. “By providing a tangible benefit that can help reduce debt and improve financial well-being, agencies can demonstrate their commitment to supporting their employees’ long-term success.”

Step-by-Step Guide to Applying

To apply for the FSLRP, employees should follow these steps:

- Review agency policies: Check with the agency’s HR department to review their policies and procedures for the FSLRP.

- Gather required documents: Employees will need to provide documentation of their outstanding federally insured student loans, as well as proof of employment and other supporting documents.

- Submit application: Employees should submit their application to the agency, which will review and approve the request.

- Work with loan servicer: Once approved, the agency will work with the loan servicer to facilitate the repayment process.

FAQs

What types of loans are eligible for repayment under the FSLRP?

+The FSLRP is available for federally insured student loans, including Direct Loans and Federal Family Education Loans (FFELs).

How much can an agency repay per year under the FSLRP?

+Agencies can repay up to $10,000 per year, with a maximum of $60,000 per employee.

Can employees participate in the FSLRP if they are already enrolled in another repayment program?

+It depends on the specific program and agency policies. Employees should review their agency's policies and procedures before applying.

How does the FSLRP impact taxes?

+The FSLRP repayments are considered taxable income, so employees should be prepared to report the payments on their tax returns.

Can agencies offer the FSLRP to part-time or temporary employees?

+No, the FSLRP is only available to full-time permanent employees of participating federal agencies.

In conclusion, the Federal Student Loan Repayment Program is a valuable benefit that can help federal employees alleviate some of the financial burden associated with student loan debt. By understanding the program’s eligibility requirements, benefits, and application process, employees can make informed decisions about their financial futures and take advantage of this valuable resource. As the program continues to evolve and adapt to the changing needs of federal employees, it’s essential to stay informed and take advantage of the opportunities it provides.