12 Atc Retirement Age Tips For Secure Futures

As the retirement age approaches, many individuals, particularly those in the air traffic control (ATC) profession, begin to contemplate their future and the security of their retirement plans. Air traffic controllers, due to the high-stress nature of their job, often have a mandatory retirement age, typically around 56 years old for those in the Federal Aviation Administration (FAA) in the United States. This unique situation necessitates early and strategic planning to ensure a secure financial future. Here are 12 tips tailored for ATC professionals and others with early retirement ages to achieve a secure and fulfilling post-career life.

1. Start Early with Retirement Planning

The key to a successful retirement is starting to plan early. Even if retirement seems like a distant reality, understanding the retirement savings options available, such as the Thrift Savings Plan (TSP) for federal employees, and contributing to them consistently can make a significant difference. Utilize retirement calculators and consider consulting a financial advisor who understands the specific needs and benefits of ATC professionals.

2. Understand Your Benefits

ATC professionals, especially those working for government agencies, have access to specific benefits and pensions. It’s crucial to understand these benefits fully, including how they are calculated, the impact of early retirement on these benefits, and any healthcare options available post-retirement. This knowledge will help in planning and maximizing the use of these benefits.

3. Diversify Your Investments

While a pension or retirement account might form the cornerstone of your retirement income, diversifying your investments can help mitigate risk. Consider a mix of low-risk investments like bonds, higher-risk but potentially higher-reward stocks, and real estate. Diversification can help ensure that your retirement is financially secure, regardless of market fluctuations.

4. Consider a Roth IRA Conversion

For those with a significant amount in traditional retirement accounts, converting some of this to a Roth IRA can provide tax-free growth and withdrawals in retirement. This strategy can be particularly beneficial if you expect to be in a higher tax bracket during retirement.

5. Healthcare Planning

Healthcare costs can be a significant expense in retirement. Understand your healthcare options post-retirement, including any coverage provided by your employer or available through programs like Medicare. Planning for potential long-term care needs is also crucial.

6. Create a Sustainable Withdrawal Strategy

Once in retirement, having a strategy for withdrawing from your retirement accounts is vital to ensure they last throughout your retirement. The 4% rule, which suggests withdrawing 4% of your retirement portfolio annually, is a common strategy, but it may need adjustment based on your specific situation and market conditions.

7. Stay Active and Engaged

Retirement isn’t just about financial security; it’s also about personal fulfillment. Consider how you want to spend your time in retirement, whether pursuing hobbies, volunteering, or starting a new venture. Staying active, both mentally and physically, can significantly enhance your quality of life in retirement.

8. Build a Retirement Budget

Understanding your expenses in retirement is crucial for planning. Create a budget that accounts for your lifestyle, travel goals, healthcare, and any other anticipated expenses. Regularly reviewing and adjusting this budget will help ensure that your retirement income covers your needs.

9. Maximize Your Home Equity

For many, their home is their largest asset. Consider how you might use your home equity in retirement, whether through downsizing to a less expensive property, taking out a reverse mortgage, or using home equity loans judiciously.

10. Plan for Inflation

Inflation can erode the purchasing power of your retirement savings over time. Incorporate inflation protection into your retirement plan by including investments that historically perform well during periods of inflation, such as precious metals or real estate.

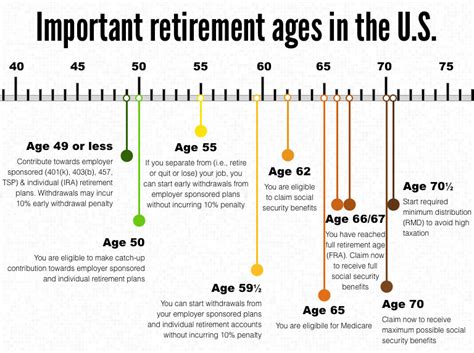

11. Develop a Tax Strategy

Taxes can significantly impact your retirement income. Develop a strategy to minimize your tax burden, including considering the tax implications of your investments, the timing of retirement account withdrawals, and how to manage required minimum distributions (RMDs) effectively.

12. Stay Flexible

Retirement planning is not a one-time event but an ongoing process. Stay flexible and be prepared to adjust your plan as circumstances change, whether due to shifts in the market, personal health issues, or changes in your retirement goals.

Conclusion

Achieving a secure future in retirement, especially with an earlier retirement age like that of ATC professionals, requires careful planning, strategic financial decisions, and a commitment to ongoing management of your retirement resources. By incorporating these tips into your retirement strategy, you can navigate the challenges of retirement planning more effectively and look forward to a fulfilling and secure post-career life.

What is the typical retirement age for air traffic controllers in the United States?

+The mandatory retirement age for air traffic controllers in the Federal Aviation Administration (FAA) is 56 years old, due to the high-stress nature of the job and the need for quick decision-making and fast reflexes.

How can air traffic controllers plan for retirement given their early retirement age?

+Air traffic controllers should start planning for retirement early, utilizing available retirement savings options like the Thrift Savings Plan (TSP), understanding their benefits, diversifying investments, and considering healthcare planning and sustainable withdrawal strategies.

What are some key considerations for creating a sustainable retirement income strategy?

+Key considerations include understanding your expenses, creating a retirement budget, diversifying your income sources, planning for inflation, and developing a tax strategy to minimize your tax burden in retirement.